The finest newsletter writer for junior resource companies to ever pick up a pen, tap away on a typewriter, or wax eloquently on a desktop keyboard was Robert Bishop, who retired from active service about fifteen years ago after publishing "The Gold Mining Stock Report" in 1983. A true gentleman and a brilliant finder of junior mining multi-baggers, Bob became a friend of mine in the 2000s and a source of inspiration when I started the GGM Advisory a few years ago. Few people know this, but without the volume created from buying, which emanated from Bob's subscriber base, billionaire Robert Friedland could never have funded his 1993 Voisey's Bay discovery.

The legendary Diamondfields nickel discovery was the most noteworthy of Bishop's enormous wins, but his massive tome entitled "Diamonds in North America," released at the start of the Great Canadian Diamond Rush in 1991 became a "bible" of sorts for newcomers like me.

Five years later, I funded the Mountain Province Mining Kennady Lake discovery, which became Canada's third major diamond mine after Lac de Gras and Diavik. In the 1990s, there were very few major discoveries that fell outside of the purview of Robert Bishop, and for that reason, he remains a legend in the halls of Canadian mining.

In 2010, I ran into Bob on the floor of Toronto's Metro Convention Centre during the early March PDAC event. I had invited the retired gentleman to participate in a 2009 private

placement in a junior Canadian explorer at CA$0.19 per unit that caught serious attention after interest in the West Timmins region was ignited by a big gold discovery. This little junior, who shall remain nameless for now, was trading massive volume due to their drill program adjacent to the discovery, but the week before PDAC arrived, insider trading reports revealed that the CEO had dumped a pile of stock above CA$1.00 during a move that took the stock to CA$1.53.

I remember Bob's exact words: "If the guy running the company decides to sell, it means that he doesn't think it is going higher. And that is good enough for me."

I learned a valuable lesson from the retired newsletter writer when he told me that one of his rules that he never broke was that whenever a CEO or President sells stock in the middle of a big price advance, he would always sell his stock, not just a partial or a piece but all of it, regardless of price.

I remember Bob's exact words: "If the guy running the company decides to sell, it means that he doesn't think it is going higher. And that is good enough for me."

I made the fatal error of trying to rationalize the sale by the CEO by thinking that he only dumped 10% of his stock, but the next week, they reported results, and the stock tanked and was never again able to reclaim either its share price or its credibility. A few years later, it was absorbed for a few pennies per share after I had finally chomped on the bullet above $0.60.

The reason I relate that story is that although it involved the junior Canadian mining space, the immortal words of Bob Bishop resonate loudly this week as the world learns that the most famous banker of recent times, J.P. Morgan-Chase CEO Jamie Dimon, sold 12% of his stock for US$140 million in a transaction explained away as "preplanned and done for tax purposes and diversification" with the added comment that Dimon "continues to believe the company's prospects are very strong and that his stake in the company will remain very significant."

When I read that, a familiar voice from northern California boomed from the back of my septuagenarian memory banks, reminding me that "If the guy running the company decides to sell, it means that he doesn't think it is going higher. And that is good enough for me."

For the biggest bull in banking history to dump stock for the first time since assuming leadership of the most powerful (and fined) bank in the world is a clear signal that all is not well in the world of financial services and banking.

My "GENERATIONAL CALL" is that junior gold and silver stocks (along with copper) will dominate the TSX Venture Exchange in 2024. Why? Because the entire sector is sold out, jettisoned, abandoned, and sponsor-less, all-powerful prerequisites for a bull market.

Dimon sailed through the Great Financial Crisis of 2008 while orchestrating to a great degree the greatest financial bailout in history without selling one share of stock; he went through a global pandemic and economic shutdown in 2020 without selling one share of stock; he watched bond yields embark on the swiftest, steepest rise in financial market history without selling one share of stock and then out of the blue, it all changed.

One has to wonder what Mr. Dimon is seeing through his sexagenarian telescope. Irrespective of that, I default back to the immortal words of Bob Bishop, and with those words, I must assume that selling shares for the first time in one's tenure as CEO means that he does not think JPMorgan Chase & Co (JPM:NYSE) can go much higher. Smart guys like Dimon rarely leave as much as a farthing "on the table" when it comes to stock market timing. It should also serve as a rapidly falling barometer in advance of an impending storm on the financial horizon. I refuse to try to determine what it is that Dimon is seeing; whatever it is, it is not good.

So, thanks to Bob Bishop once again for indelibly etching an important lesson into the frontal lobe of an ever-aging yet grateful brain.

Gold

The big gold advance that began in early October is still intact but needs to work off the overbought conditions that are now fairly evident in the MACD and MF indicators.

Although RSI was not able to move above 70 during the advance, the other indicators moved enough to warrant caution, with the RSI resting comfortably just under the 70 level at 69.45. Until today.

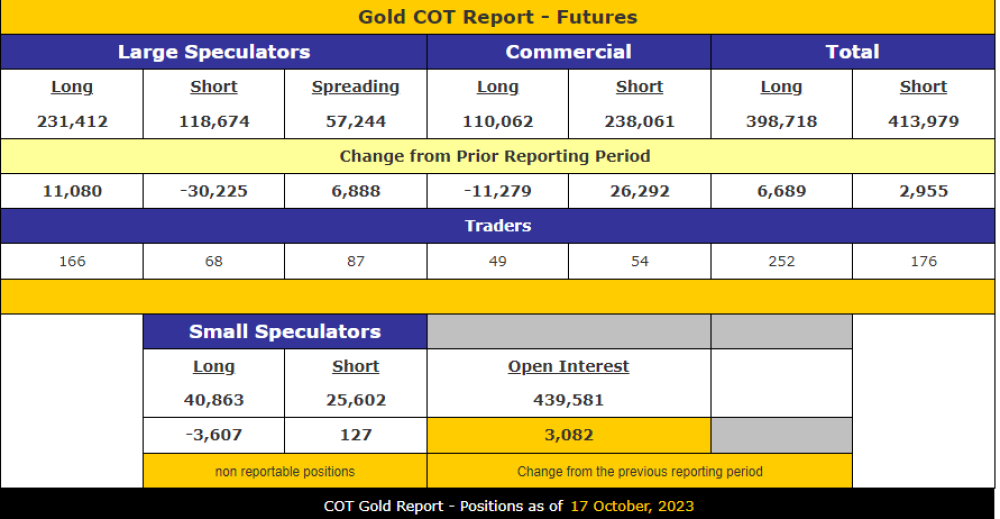

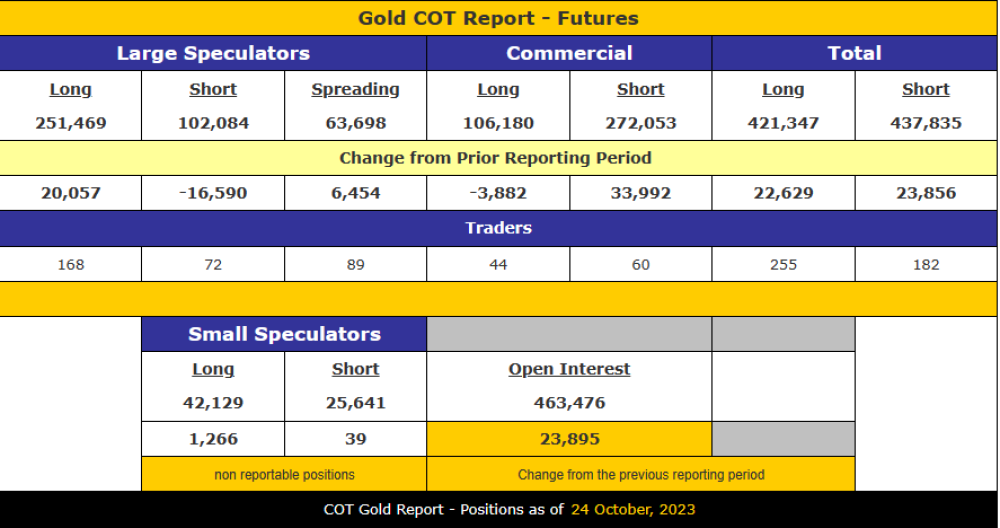

The Commercial traders, as of October 17, had sold 37,571 contracts the prior week, after which the price exploded further from the Tuesday closing price of US$1,935/ounce to US$2,009/oz. three days later. It looked as though they might be successful because the gold miners acted as if the US$150 move was a false breakout.

VanEck Gold Miners ETF (GDX:NYSEARCA:) pulled back from last Friday's high at US$30.16 to Thursday's intraday low at US$28.09 before bottoming.

That was ten days ago — now look at what happened last Tuesday. Commercials hammered another 37,874 contracts down to US$1,965/ounce, making it 75,445 contracts representing 7,544,500 notional ounces in two weeks.

As this is being written on Friday afternoon, gold has exploded out of the gate and is quoted at US$2,017.30, so if I take an average Commercial shorting price over the past two weeks at US$1,950, they are offside over half a billion dollars.

GDX:NYSE turned on a dime and soared back to go out at US$29.19, but with a gold price US$10 higher than the top from last week at US$2,009.20, GDX is a clear picture of how the gold miners are acting like stocks first and gold second.

(For those youngsters out there, in the 1970s, gold stocks used to go UP on sharp down says in the S&P500.)

I stand by my forecast of new highs by New Year's Day, and now that we have achieved escape velocity above US$2,000/ounce, I see little resistance until the old highs around US$2,089.

Stocks

I guess Jamie knew that U.S. markets would be entering into "correction" mode because there are only two trading days left in the "bear-killer" month and the way this week ended, I am reminded of the famous Friday, October 16, 1987 episode of Louis Rukeyser's "Wall Street Week" where the host almost fainted when, in response to a question about the Friday sell-off of 103 Dow points, Zweig replied: "I've kinda been looking for a bear market, but I really think it could be a crash but I didn't want to talk about it because it is like shouting "FIRE!" in a crowded theatre."

The following Monday, Marty became a legend with one of the greatest calls in stock market history as stocks went "NO BID" and pared 22% in one day's trading. Now, that is NOT going to happen this time because mutts like me are talking about it, and every kid under the age of thirty is long up to the back teeth with put options.

Nevertheless, it feels like something "eerie" is about to happen over the weekend, and while I have little faith in "ad hoc reverberation analysis," I have learned never to ignore gold and that it spiked at the end of the trading week is almost as if Vlad the Impaler learned from the Ayatollas that a nuclear device was going to be set off in the Bronx just to "teach them Israelis a freaking lesson."

I am holding my SPY calls (which are a pittance compared to my gold holdings) because it is too late to sell them and because if the past is prologue, any sort of "crash" will be followed by a wicked rally. That rally will move my SPY calls to profitability in a (excuse me) "New York Minute," which we all know is a nanosecond in human terms.

Junior Resource Stocks

From October '87 to October 1997, my net worth went from negative $250k to plus $10 million in ten years. Being a junior resource investor and stock salesman (as opposed to a "wealth advisor" or "portfolio manager"), I made a living out of helping geologists and prospectors navigate the Ivory Towers of Bay Street, where they had no experience and no friends.

Every time a truly talented rockhound from Timmins or North Bay or Sudbury came into Toronto, they would call me to find out whether there was any chance of me "grubstaking" their project. Don't get me wrong; these northern Ontario guys were no dummies; they learned in the 1950s and 1960s to never trust "the suits" on Bay Street. From my vantage point as a kid in the 1960s from outside of the downtown area, I remember the first time I went downtown with my dad to his office, staring up at the buildings and jumping every time the streetcar bells started to clang.

That was how I determined which of my prospective clients were "real." If they claimed to be prospectors from the North but would never stare at the buildings, I would walk away. If they could barely look at me or talk and instead walk with heads arched upward in absolute AWE of downtown Toronto, I knew they needed help and passed the test.

This weekend should be eventful from a geopolitical perspective but not from a market perspective. Huge money is waiting on the sidelines, and it will deploy. The challenge is for me to determine exactly where my call is gold.

I guess what has happened over the years is that the liars and thieves and confidence men that used to dominate street corners and bars (but never boardrooms) in Vancouver and Toronto learned how to navigate within those financial islands and atolls and reefs and wound up eventually dominating the junior mining space and as always happens when the pickings get too easy, the spoils of larceny eventually dry up, and investors run for the proverbial hills.

One look at the chart of the TSX Venture Exchange gives me the sense that investors are disgusted with the space. In the 1990s, it was a superb investment arena. In the 2020s, it has become a toxic waste dump, with the major question being: "Is this a contrarian investment opportunity or a punctuation mark?"

The new generation of investors has made nary a dime in the junior gold, silver, or copper space. They have made money in lithium and uranium, but only spottily in 2023.

My "GENERATIONAL CALL" is that junior gold and silver stocks (along with copper) will dominate the TSX Venture Exchange in 2024. Why? Because the entire sector is sold out, jettisoned, abandoned, and sponsor-less, all-powerful prerequisites for a bull market.

This weekend should be eventful from a geopolitical perspective but not from a market perspective. Huge money is waiting on the sidelines, and it will deploy. The challenge is for me to determine exactly where my call is gold.

We shall see.

Sign up for our FREE newsletter

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.